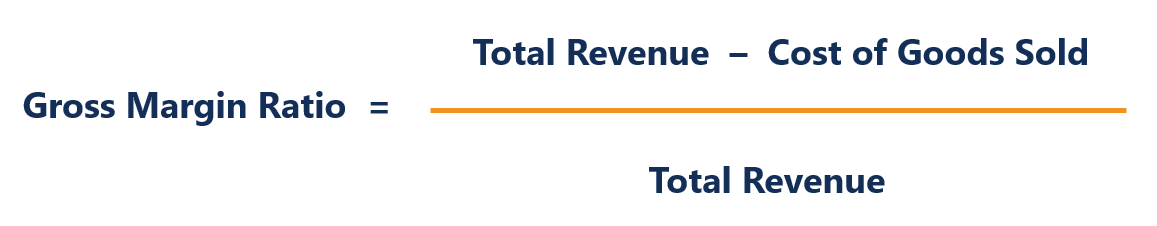

Gross margin ratio formula

To interpret this percentage we need to look at other similar companies in the same industry. Although the gross profit ratio formula itself is simple and easy to calculate a few steps go into figuring out the variables that go into the formula.

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Gross Margin Gross Profit Revenue 100.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

. Calculate Gross Profit Margin. Asset Coverage Ratio 15 Which shows the Optimum capacity of Asset coverage by ABC. Using the formula the gross margin ratio would be calculated as follows.

Guide to Inventory Turnover Ratio Formula here we discuss its uses with practical examples and Calculator with downloadable excel template. Cost of production per unit 3. Here the gross margin ratio is 70.

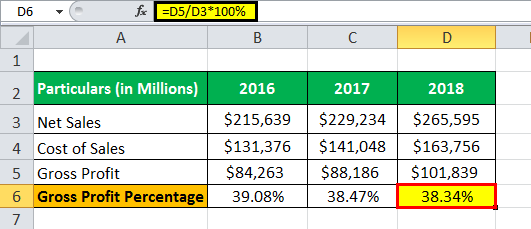

The gross profit margin also known as gross profit rate or gross profit ratio is a profitability metric that shows the percentage of gross profit of total sales. Gross margin is the difference between revenue and cost of goods sold COGS divided by revenue. These core financial ratios include accounts receivable turnover ratio debts to assets ratio gross margin ratio etc.

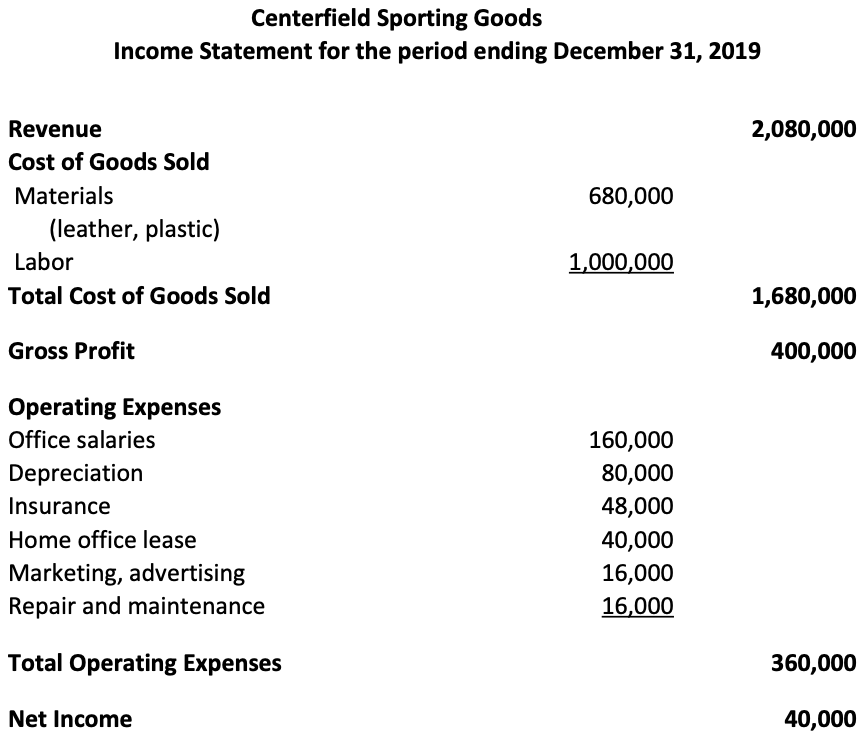

It is calculated as gross profit divided by net sales. Net sales are equal to total gross sales less returns inwards and discount allowed. The gross profit margin on the other hand is also known as the gross margin ratio or the gross profit percentage.

This is the contribution margin ratio. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. Is 30 for the year.

Gross profit margin which is a percentage is calculated by dividing gross profit by revenue. Next figure out the cost of goods sold or cost of sales from the income statement. But it is quite useful to understand your business performance.

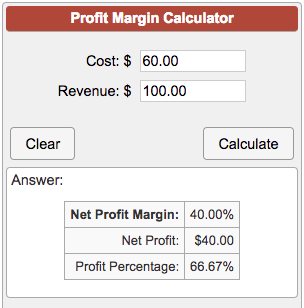

Coverage Ratio Formula Example 2. The gross margin ratio can be calculated by our formula. Net profit margin is the ratio of net profits to revenues for a company or business segment.

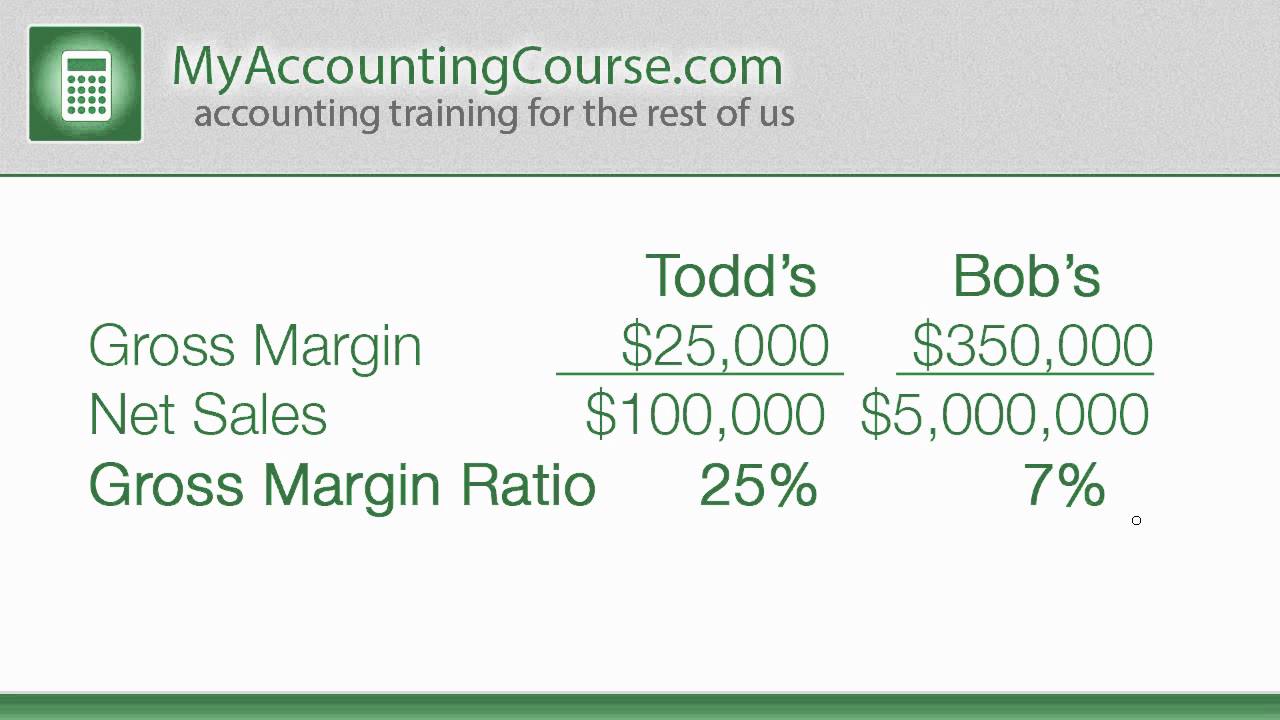

The Gross Margin Ratio also known as the gross profit margin ratio is a profitability ratio that compares the gross profit of a company to its revenue. Gross profit is equal to net sales minus cost of goods sold. Price to Earnings PE is one of the most popular ratios formulae that are being used by investors for valuing companies and taking investment decisions.

The gross margin represents the percent of total. According to our formula Christies operating margin 36. Production or acquisition costs not including indirect fixed costs like office expenses rent or administrative costs then divided by the same.

The margin of safety is a financial ratio that measures the amount of sales that exceed the break-even point. It is measured using specific ratios such as gross profit margin EBITDA and net profit margin. Every financial ratio has its benefits and there are a number of reasons.

Firstly figure out the net sales which are usually the first line item in the income statement of a company. From the above calculation for the gross margin we can say that the gross margin of Honey Chocolate Ltd. Gross profit margin is a financial metric used to assess a companys financial health and business model by revealing the proportion of money left over from revenues after accounting for the cost.

Another formula used to calculate it is product gross profit margin divided by product selling price. Only 36 cents remains to cover all non-operating expenses or fixed costs. Gross Profit Margin Formula.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. What is PE Ratio Formula. PE Ratio is Calculated Using Formula.

Gross Profit Ratio Formula Gross ProfitNet Sales X 100 Usually expressed in the form of a percentage You are free to use this image on your website templates etc. Now youve learned how to calculate gross profit percentage. 102007 39023 102007 06174 6174.

Net income or net profit may be determined by subtracting all of a companys. This means that 64 cents on every dollar of sales is used to pay for variable costs. The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales.

Gross profit margin is expressed as a percentage so you must multiply the resulting number by 100 to get the correct result. Price to Earnings Ratio Market Price of Share Earnings per Share PE 165481191. Using the gross profit margin formula we get.

This is not a percentage but is based on the per-unit calculations. Now we can use our second formula. Gross margin is expressed as a percentageGenerally it is calculated as the selling price of an item less the cost of goods sold e.

Let us also calculate the unit margin. Asset Coverage Ratio 3600000 600000 2000000. ABC is currently achieving a 65 percent gross profit in her furniture business.

All in One Financial Analyst Bundle 250 Courses 40 Projects 250 Online. Conceptually the LTVCAC ratio is calculated by dividing the total sales or gross margin made to a single customer or customer group over their entire lifetimes LTV by the cost required to initially convince that same customer or customer group to make their first purchase CAC. It is important to compare this ratio with other companies in the same industry.

Gross Margin of Colgate. In finance the Sharpe ratio also known as the Sharpe index the Sharpe measure and the reward-to-variability ratio measures the performance of an investment such as a security or portfolio compared to a risk-free asset after adjusting for its riskIt is defined as the difference between the returns of the investment and the risk-free return divided by the standard. Profit margin is a profitability ratios calculated as net income divided by revenue or net profits divided by sales.

The formula for Gross Margin can be calculated by using the following steps. Typically expressed as a percentage net profit margins show how much of each dollar collected by a. Note that essentially this calculation is a measure of the return on.

In other words this is the revenue earned after the company or department pays all of its fixed and variable costs associated with producing the goods or services. Gross Profit Margin Formula Gross profit margin is calculated using the following basic formula. The gross margin ratio is a helpful comparison.

Gross margin is a companys total sales revenue minus its cost of goods sold COGS divided by total sales revenue expressed as a percentage. Pros of Gross Profit Margin. However there is one financial ratio that you often overlook.

Price per unit 10. The formula of gross profit margin or percentage is given below.

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Profit Margin Formula And Ratio Calculator Excel Template

Gross Margin Ratio Formula Analysis Example

Gross Margin Definition For B2b Saas Kpi Sense

How To Calculate Gross Margin Percentage Incubeta Panalysis

Gross Margin Baremetrics

What Is Gross Margin And How To Calculate It Article

Gross Margin What It Is Formulas And Some Examples

Gross Profit Margin Formula Meaning Example And Interpretation

Gross Margin Ratio Formula Analysis Example

Gross Profit Percentage Double Entry Bookkeeping

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Profit Margin Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Margin Ratio Learn How To Calculate Gross Margin Ratio

Gross Profit Margin Formula And Calculator Excel Template